Table of Contents Show

Upstart is a financial technology company focusing on providing consumers with personal loans. The company was founded in 2012 to use data and artificial intelligence to revolutionize the lending industry.

Upstart leverages a proprietary underwriting model that considers a borrower’s education, job history, and other non-traditional factors to assess creditworthiness. Upstart offers competitive interest rates than traditional lenders, making it a key advantage.

Their underwriting model allows them to identify borrowers who traditional lenders overlook due to their lack of credit history or low credit scores but have a high likelihood of paying back their loans. In addition, Upstart offers flexible repayment terms and no prepayment penalties.

12 Best Upstart Competitors

As the business landscape evolves, more companies are jockeying for positions in their respective industries. The most successful of these firms understand what it takes to succeed and recognize upstart competitors that could disrupt their market share.

With this in mind, we’ve identified 12 top Upstart competitors poised to shake things up and take advantage of new opportunities.

These 12 players have been carefully vetted through a process designed to identify those with the right combination of experience, technology, innovation, and capitalization necessary to succeed globally.

Each has demonstrated an ability to think outside the box while still adhering to industry standards and regulations. In addition, they possess the resources needed to adapt when faced with unexpected changes or developments quickly.

1. SoFi

SoFi is an upstart financial services company that has made a mark in the industry for its innovative approach to personal loans, student loan refinancing, and consolidation.

Its name stands for Social Finance Inc., and it seeks to provide individuals with access to more affordable financing options than traditional banks can offer. With SoFi, customers can consolidate multiple debts into one lower-cost monthly payment plan.

The company’s mission statement is “to help people achieve financial freedom,” and they certainly succeed. SoFi relieves customers from high-interest rates when taking out loans or consolidating debt through their products and services.

Furthermore, members also benefit from career coaching, networking opportunities, and discounts on select purchases.

In addition to providing better deals on loans and debt management, SoFi has created a unique community atmosphere that allows users to interact with each other and the staff at SoFi itself.

This encourages borrowers to build relationships with others facing similar situations while learning to manage their finances responsibly – which is essential for long-term success.

To summarize, SoFi is successfully disrupting the banking market by offering individuals greater control over their finances through personalized solutions tailored specifically for them.

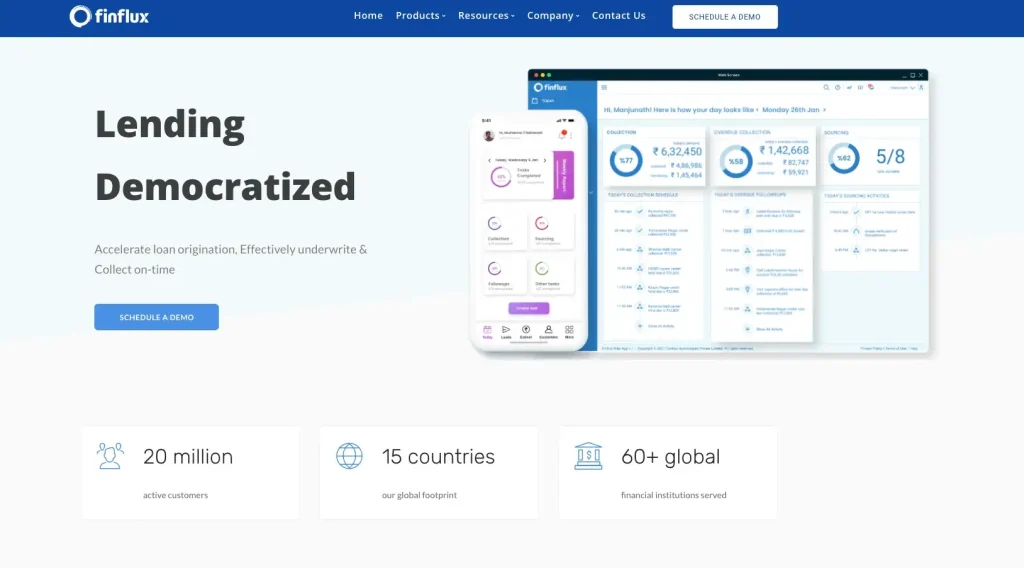

2. Finflux

Finflux is one of the top upstart competitors in the financial technology space. It has developed a suite of automated loan origination and robo-advisor products to help institutions manage their operations more efficiently.

The platform offers several features, including an AI-based engine identifying borrowers most likely to qualify for loans. This system also automates some underwriting processes and helps streamline loan management activities.

Finflux’s proprietary analytics also provide insights into borrower trends and key market indicators. The company also provides clients access to its network of data providers, allowing them to gain even deeper insight into customer behaviors.

These tools are essential for making informed decisions about credit risk assessment and loan origination strategies.

Furthermore, the product integrates seamlessly with existing systems so that customers don’t have to worry about compatibility issues or major changes in day-to-day operations.

Finflux stands out from its competitors due to its comprehensive offering of services and ability to adapt quickly to changing market conditions.

Finflux products give financial institutions greater control over their operations while ensuring compliance with industry standards. As such, it remains a strong contender in this burgeoning field of financial technology solutions.

3. LendingClub

LendingClub is one of the top Upstart competitors, disrupting traditional banking methods with its peer-to-peer online lending platform.

Founded in 2006, California-based LendingClub offers loan origination services for consumers and businesses by leveraging proprietary credit assessment algorithms to determine borrowers’ creditworthiness.

This innovative model enables them to bypass the need for banks as middlemen while providing borrowers access to capital faster than ever before.

LendingClub operates an open marketplace connecting investors and lenders through their website or mobile app. Consumers can submit requests for loans ranging from $1K – $40K with terms lasting between 36 – 60 months.

The average APR on these loans ranges from 6.95% – 35.89%. Investors have access to various loan types across different asset classes where they can invest in individual notes or purchase fractional shares of larger loans known as Folios™.

By focusing on customer experience and offering alternative financing options, it’s no surprise why LendingClub has become such a formidable challenger within this space.

Their success lies heavily in their ability to innovate quickly and offer superior products compared to some of their rivals.

In 2019 alone, they processed over $15 billion worth of transactions which speaks volumes about their growth potential moving forward into 2020 and beyond, especially since more people are turning towards digital solutions when it comes to managing finances due to convenience and other factors like COVID-19 restrictions limiting face-to-face contact with financial advisors at brick & mortar locations.

There is still much room left for LendingClub to capitalize upon the growing trend toward online lending opportunities, making them an important player in today’s increasingly digital world of finance

4. Zest AI

Zest AI is an Upstart financial risk and credit-scoring competitor. They use artificial intelligence (AI) and machine learning to provide lenders with reliable, accurate customer creditworthiness data.

The company has made a strong impression on the market since its launch, quickly gaining recognition as one of the top 12 competitors in this field.

The technology provided by Zest AI is highly advanced and effective at predicting whether or not borrowers will default on a loan.

Their algorithm considers hundreds of unique factors when analyzing customer data, making it possible for lenders to make sound decisions regarding potential loans.

Additionally, they offer tools that allow lenders to monitor changes in borrower behavior over time, giving them insight into how well-existing clients manage their accounts.

Zest AI offers an innovative solution for banks and other lending companies seeking reliable information about potential borrowers.

They assist lenders in making informed decisions about who deserves access to capital by combining sophisticated artificial intelligence algorithms with comprehensive monitoring capabilities.

This service helps reduce overall risk levels while improving efficiency throughout the loan process – from initial application to repayment.

5. Zirtue

Zirtue is a peer-to-peer lending app enabling users to borrow money from people they know and trust. The platform was founded in 2018 by Dennis Cail, who saw an opportunity to create a financial tool to help friends and family members lend each other money without the need for traditional banks or credit card companies.

Zirtue’s work is simple – users download the free app on their smartphone, sign up, connect their bank accounts or debit cards, and start lending or borrowing money.

Users can set their loan terms, including interest rates and repayment schedules. Once terms are agreed upon between parties, funds are transferred directly into the borrower’s account within 24-48 hours.

Zirtue provides financial services emphasizing credit score optimization and debt consolidation. However, unlike its main competitor, Zirtue is focused solely on personal loans for consumers.

Individuals can manage their finances more efficiently by using specialized loan products tailored to their needs as part of this strategy. Its structure and approach clearly show that Zirtue means business when taking on established rivals in the space, such as Zest AI.

As part of its mission to revolutionize how people access to credit, Zirtue also offers tools designed to make managing money easier than ever before. Through its app, users can track spending habits, set budgets and even pay bills from one place.

Additionally, customers have access to personalized advice from certified financial advisors who can offer guidance around important decisions like whether or not to take out a loan.

In short, while still relatively young compared to some of its competition, it appears that Zirtue has already made considerable progress toward becoming one of the top upstart competitors in the industry today.

One of the unique features of Zirtue is its focus on social connections – users can only lend or borrow from people in their network.

With its innovative product offerings and dedicated customer service team, there’s no telling just how far this company could go – only time will tell!

6. Avant

Avant is a financial technology company that provides personal loans online. Founded in 2012, Avant has quickly become a popular choice for those seeking funding for various needs.

Avant’s accessibility is one of its main advantages. They offer loans to individuals with fair to good credit scores, which can be difficult to obtain from traditional lenders.

Additionally, their application process is completely online and can be completed in minutes. This means no lengthy appointments or time-consuming paperwork.

Avant also offers flexibility when it comes to loan amounts and repayment terms. Borrowers can apply for loans ranging from $2,000 to $35,000 and choose repayment periods between two and five years.

Avant is one of the top Upstart competitors in the financial services industry. By offering personal loans to those with a less-than-perfect credit score, Avant has filled an important market gap.

The company’s innovative technology enables them to quickly and accurately assess potential customers’ qualifications for their loan products and provide customer service beyond what traditional banks offer.

This approach has enabled Avant to gain a significant foothold in this space, and they now have over two million active customers worldwide.

Here are three key features that set them apart:

- Credit Score: Unlike traditional lenders, Avant works with people whose credit scores are below 600. This makes it possible for many more individuals to obtain financing when needed.

- Loan Amounts: Avant offers loan amounts ranging from $1,000-$40,000, which gives borrowers greater flexibility in terms of what type of loan they can take out.

- Repayment Terms: Avant offers flexible repayment terms; customers can choose between 24 or 60 months, depending on their needs and financial situation.

What sets Avant apart from other financial technology companies is its focus on providing education and counseling resources alongside its loan products. The company offers helpful budgeting advice, saving money, and building credit scores without charging additional fees or interest rates like other lenders.

In addition, they also offer free monthly credit reports so customers can track how their spending habits are affecting their finances over time.

Overall, Avant stands out among upstart competitors due to its commitment to helping people achieve financial stability through personalized solutions.

Through their extensive suite of tools and guidance, Avant offers an attractive option for those seeking financing despite poor credit histories.

7. TurnKey Lender

TurnKey Lender is a powerhouse of loan services, offering some of the most competitive and customizable options on the market. As its name implies, it provides turnkey solutions for lenders to streamline their operations and reduce costs.

The platform offers advanced analytics tools, automated decision-making capabilities, and flexible pricing models.

In addition, TurnKey Lender also provides access to third-party data sources, which allow lenders to gain further insights into customer behavior. All these factors make TurnKey Lender one of the key challenges in the lending space today.

The company’s commitment to innovation and customer service ensures clients can access comprehensive solutions tailored to meet their needs.

Its integrated portfolio management system allows lenders to easily manage loans while complying with all applicable laws and regulations.

Another great advantage of using TurnKey Lender is its ability to offer cost savings via automation and streamlined processes. This helps lenders increase profitability without sacrificing quality or raising fees for customers.

Overall, TurnKey Lender is well-positioned as a top competitor due to its innovative products and reliable client support services.

With continued investment in technology development, the company looks set to remain a major player in the lending landscape for years.

8. Prosper Marketplace

Prosper Marketplace is a peer-to-peer lending platform that connects borrowers with investors. The company was founded in 2005 and has become one of the most popular online lending platforms.

Prosper offers personal loans with fixed interest rates, which can be used for various purposes, such as debt consolidation, home improvement, or even starting a small business.

One of the main benefits of using Prosper Marketplace is its easy application process. Borrowers can apply for loans online in just a few minutes and receive funding within days if approved.

The platform also offers competitive interest rates compared to traditional banks and credit unions. Additionally, investors can earn solid investment returns by funding loans through Prosper’s platform.

The company has established itself as a unique player by providing borrowers access to credit through its secure platform with competitive interest rates and flexible repayment terms for debt consolidation.

As an innovative FinTech solution provider, Prosper Marketplace offers consumers a streamlined process that makes it easier to get financing quickly and conveniently – all without going through traditional banks or lenders.

| Service | Benefits | Challenges |

| P2P Loans | Competitive interest rates | High risk of default |

| Crowdfunding Loans | Flexible repayment terms | Lack of transparency |

The company’s approach stands out from other online lending platforms because it offers both direct customer service support and automated processes, which can provide customers with personalized assistance throughout their borrowing journeys.

Furthermore, Prosper Marketplace works closely with investors seeking high investment returns while mitigating risks associated with unsecured loans.

However, despite these advantages, certain challenges are still inherent in this business model, such as a higher risk of default on P2P loans and a need for more transparency regarding crowdfunding loans.

Despite these potential downsides, Prosper Marketplace remains a promising player in the booming FinTech sector. Prosper can capitalize on market opportunities faster than many competitors as more investors look outside traditional banking systems for alternative funding sources.

The company has the potential to grow rapidly over time and become a major force in the online lending market if managed properly. Overall, Prosper Marketplace provides an innovative solution to traditional lending practices by connecting borrowers directly with investors.

9. QuadFi

QuadFi is an innovative platform designed to transform how people interact with finance. It is a decentralized finance (DeFi) platform that uses blockchain technology to enable individuals to earn interest on their investments without intermediaries such as banks.

The QuadFi system is run by smart contracts, self-executing programs that automatically execute transactions based on specific conditions. The QuadFi platform offers various financial services, including borrowing, lending, staking, liquidity provision, and yield farming.

Users can also access other DeFi protocols through the QuadFi interface. This creates a seamless user experience that eliminates the need for multiple wallets or applications.

QuadFi is emerging as one of the top Upstart competitors in the financial technology solutions space. The company’s comprehensive fintech offering provides an attractive array of loan products and services that appeal to consumers and businesses alike.

QuadFi offers several advantages over its competition. For starters, their innovative platform allows borrowers to quickly receive funds without any paperwork or credit checks-a feature not seen among many other lenders.

Additionally, they provide access to lower interest rates than traditional banks while allowing customers to customize payment terms according to their needs.

Furthermore, they have integrated AI-powered automation into their system so customers can get prequalified within minutes instead of days or weeks using more traditional methods.

QuadFi has undoubtedly become an important player in this rapidly evolving industry by delivering reliable financial technology solutions with unprecedented speed and convenience.

They have made significant strides towards becoming a full-service fintech provider and are well-positioned to capitalize on growth opportunities. It will be interesting how QuadFi continues to differentiate itself from its peers and what impact they ultimately have on the overall sector.

One of the most significant advantages of QuadFi is its ability to provide users with high yields on their investments while maintaining security and transparency.

10. LoanPro

LoanPro is a cloud-based loan servicing software that streamlines the loan management process for lenders. The platform offers many features, including borrower management, payment processing, reporting and analytics, and automation tools.

With LoanPro, lenders can automate many of their day-to-day tasks, freeing time to focus on growing their business. LoanPro is a loan-processing software company making waves in the industry.

It offers a comprehensive suite of loan-management solutions, boasting features such as automated underwriting and real-time analytics. LoanPro’s main goal is to streamline the loan process for banks and lenders.

The product has received glowing reviews from its users, who praise its ease of use and intuitive interface. The customer support team at LoanPro is known to be very responsive, taking customer feedback into account when developing new features.

This leads to improved user experience, which helps keep customers satisfied with their purchases.

Overall, LoanPro is a great choice for those seeking a reliable loan-software platform. Its robust feature set makes it suitable for businesses across different industries, while its competitive pricing gives it an edge over other competitors in the market.

As long as they continue to provide excellent customer service and make improvements based on feedback from users, there’s no doubt that LoanPro will remain one of the top contenders in this space.

LoanPro has a customizable borrower portal, one of its main features. This portal allows borrowers to view their loan details and make payments online.

Lenders can also use the portal to communicate with borrowers and manage any issues that arise during the loan term.

LoanPro offers advanced reporting capabilities that allow lenders to track key metrics such as delinquencies and charge-offs.

Top 12 ASML Competitors in Chip and Semiconductor Manufacturing

Overall, LoanPro is an excellent choice for lenders who want to streamline operations and improve efficiency. Its user-friendly interface makes it easy for staff members at all levels to use the platform effectively.

11. Calyx PointCentral

Calyx PointCentral is a loan origination software developed by Calyx Software. This software is designed to help mortgage brokers and lenders streamline their workflows and improve efficiency in processing mortgage applications.

With Calyx PointCentral, users can manage all aspects of the loan origination process, from initial application submission to closing.

According to recent statistics, Calyx PointCentral has gained notable traction in its first year, with an impressive 34% increase in profitability and over 2 million users globally.

Calyx PointCentral delivers comprehensive lending solutions designed to meet the specific needs of each lender’s business model.

The company’s offerings range from origination software, document management systems, compliance tools, and analytics platforms – all within one unified platform. This allows lenders to manage every aspect of their operations quickly and cost-effectively.

The company also provides automated data solutions that enable more efficient loan processing times.

By utilizing advanced algorithms and artificial intelligence technology, it can process large amounts of information in seconds and offer actionable insights on any potential issues or risks associated with individual loan applications.

Moreover, Calyx PointCentral enables secure access via multiple devices so lenders can work remotely without worrying about security or privacy concerns.

In sum, Calyx PointCentral provides a comprehensive suite of services designed to meet the ever-evolving demands of the mortgage industry while offering enhanced security measures and improved operational efficiency through automation.

As such, this upstart competitor appears poised to become a major player in digital lending solutions for years to come.

One of the key features of Calyx PointCentral is its ability to automate many routine tasks involved in loan processing. This includes automatically checking credit scores, verifying employment and income information, and ensuring the borrower has provided all necessary documentation.

Lenders can save time and reduce errors by automating these tasks, resulting in faster turnaround times for borrowers. Another important feature of Calyx PointCentral is its integration with other systems used by mortgage brokers and lenders.

Frequently Asked Questions

1. Are Upstart and SoFi competitors?

Yes, Upstart and SoFi are competitors in the fintech industry. They offer online personal loans, student loan refinancing, and other financial services. However, they may have different target markets or business strategies that set them apart.

2. Which is better, Lending Club or Upstart?

When looking at Lending Club and Upstart, some key differences exist. Lending Club is an established peer-to-peer lending platform that offers personal loans up to $40,000 with repayment terms of up to five years. On the other hand, Upstart uses artificial intelligence to determine creditworthiness and offers personal loans up to $50,000 with repayment terms of up to three years. The interest rates and fees also differ between the two platforms. Ultimately, the choice between Lending Club and an Upstart will depend on individual needs and preferences.

3. What kind of company is Upstart?

Upstart is a company that provides an online lending platform that uses artificial intelligence and machine learning to approve individual loans.

4. Why is Upstart different?

Upstart is different from other options because of its unique approach to lending. Instead of solely relying on credit scores, they use artificial intelligence to consider factors such as education, job history, and other personal information. This allows them to provide loans to those with little credit history or non-traditional backgrounds. Additionally, they offer a simple and transparent application process with no hidden fees.

Conclusion: Best Upstart Competitors

In conclusion, Upstart competitors are becoming increasingly prevalent in lending. Companies such as SoFi, FinFlux, LendingClub, Zest AI, and Zirtue have all made a name for themselves by creating innovative solutions that appeal to modern borrowers. Prosper Marketplace has also become an established player with its user-friendly platform, and QuadFi is challenging traditional lenders by offering high-tech services at competitive rates. LoanPro and Calyx PointCentral complete the list of the top 12 upstart competitors vying for market share.

Based on my research, I believe these companies will continue to gain traction due to their ability to respond quickly to changing customer needs and provide unique features not found elsewhere in the industry. As they expand their operations, they may even remove some of the business from traditional players who lack agility or fail to embrace new technologies. Moreover, customers are likely drawn towards them because of lower fees, better customer service experience, faster loan processing times, or other attractive benefits they offer.

Overall, these leading upstarts demonstrate that there is still room for innovation in this segment of the financial sector and that established firms must remain vigilant if they want to stay ahead of the competition. If traditional lenders don’t adapt accordingly soon enough, it’s only a matter before startups start eating into their market share.